When you hear the words "Cost Variance," "Schedule Variance," and "Performance Variance," do you immediately jump to the conclusion that the variance is negative and the project is somehow not where it is supposed to be? If you did, don't worry, you're not alone. All too often the word "Variance" is an unwelcome sound when delivering project status, so much so, that it fuels many Project Managers to sanitize or oversell their project's status. This is where projects tend to miss the built-in warning signs. You see, variance does not want to be taken for what's on the surface (typically represented by a numerical value or stoplight chart); it wants us to look under the hood to diagnose the issue and make a decision about what to do.

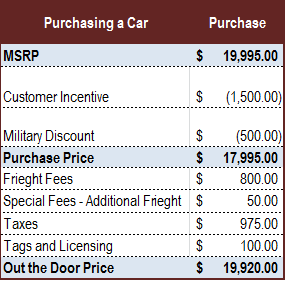

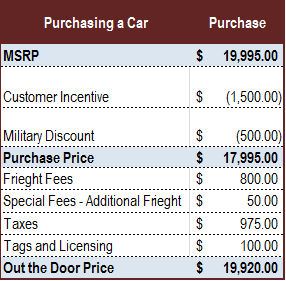

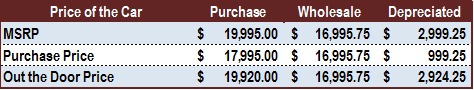

Since the car analogy seems to be taking shape, let's roll with it to better understand variance. Imagine you are at a car dealership, preparing to purchase a brand new car... The car has a Manufacturer's Suggested Retail Price (MSRP) of $19,995.00.  You, a master in the art of negotiation, are able to reduce the MSRP by $2,000.00, resulting in a Purchase Price of $17,995.00.

You, a master in the art of negotiation, are able to reduce the MSRP by $2,000.00, resulting in a Purchase Price of $17,995.00.

Here we have our first variance of negative $2,000.00 or 10%. The variance on the surface makes you feel good, but let's continue.

The salesman goes off and prepares the paperwork and when he returns the final documents say you owe $19,920.00. This is what is commonly referred to as the Out the Door Price or On the Road Price. What happened,didn'tyou just settle on $17,995.00? Where did the positive variance of$1,925.00 or 10.6% come from? And wait, how come the initial variance reduced the price by 10% but now it increased the price by 10.6%? Without understanding the basis of the numbers and what story they are telling, you probably feel a bit hustled at the moment. Let's pull over for a minute and put this in the context of managing projects: There are many factors that contribute to the "Real Price" the dealer can set for a vehicle. (1) The dealer's invoice, (2) hold-backs and factory to dealer incentives, (3) the dealer's operating cost, (4) and targeted profit all play major roles in the variables that make up the Purchase Price offered to customers. Similarly there are many factors that go into estimating the cost that will be incurred to complete the project; to include: type of labor, materials and services required to deliver on the project scope and quality, the timeline for completion, and targeted profit. Even after an agreeable purchase price is established, there are sometimes less obvious costs that are not addressed or accounted for in negotiations. In the example above, this included taxes and fees for freight, tags, and licensing that added up to almost the same amount that was negotiated down. Now consider if the cost factors had been estimated as part of the advertised price, would the negotiation seem more satisfying if it had gone from ~$22,000 (Advertised Price) to $19,920.00 (Out the Door Price) instead of MSRP ($19,995.00) to Negotiated Purchase Price ($17,995.00) to Out the Door Price ($19,920.00)? The variances behind the numbers remain unchanged, but the delivery of the numbers has been presented in a more gratifying manner to the buyer. The basis for a project's estimated cost is often times represented to suite a specific stakeholder or group of stakeholders. This representation may:

- Be inflated due to uncertainty and the fear of being negotiated down

- Exclude costs that will ultimately impact the actual cost at completion for the project

- Neglect to account for contingencies

- Lack clarity in what is being delivered within the cost and elements out of scope

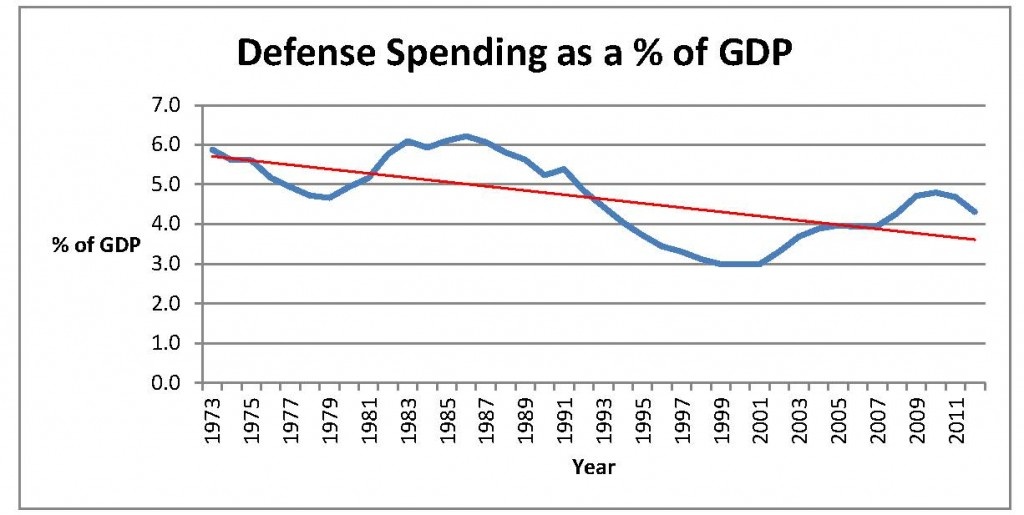

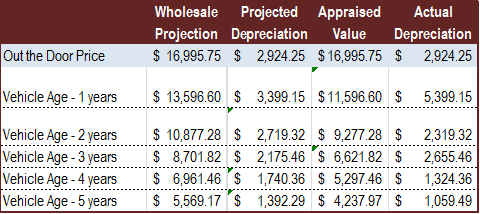

Ok, now that you are feeling better about the "Price", let's get back on route... Depending on how you relate to the "Price" of the car, be it MSRP, the Purchase Price, or the Out the Door Price - the Wholesale Price at the time of purchase is a constant The moment you take possession of the vehicle it depreciates from the Purchase Price to the Wholesale Price. So, the "Price" you relate to will determine how much depreciation you realize: $2,999.25 (MSRP - Wholesale), $999.25 (Purchase Price - Wholesale) or $2,924.25 (Out the Door Price - Wholesale).  This is important, because if you don't understand that the three sets of numbers are actually telling only one story (the car depreciates to its wholesale value), then you may be inclined to think that the deal resulting in a depreciated value of only $999.25 is the best value. Or even worse, because you didn't understand enough about car valuation and selling practices, you planned for no depreciation at the time of purchase and are upset that you walked away with a negative variance between the car's value and the price you paid to purchase it. In managing projects it is important to understand the factors that influence and impact the execution of the project baseline so that thresholds for expected and acceptable variances can be established. It is much easier for project stakeholders to seek to understand a reported variance when variance thresholds have been communicated and planned for. So we now accept that the car depreciates, but what can we expect over time? On average cars tend to depreciate at about 15-20% of their value per year, with the first year being the steepest drop. With this knowledge, you can project the value of the car over time and expect the depreciation that coincides. The Wholesale Projection and Projected Depreciation columns in the table below provide the expected value of the vehicle over the next five years.

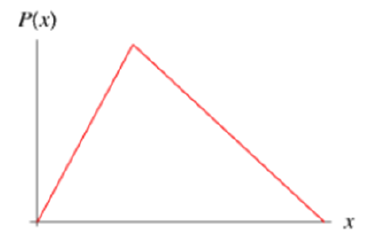

This is important, because if you don't understand that the three sets of numbers are actually telling only one story (the car depreciates to its wholesale value), then you may be inclined to think that the deal resulting in a depreciated value of only $999.25 is the best value. Or even worse, because you didn't understand enough about car valuation and selling practices, you planned for no depreciation at the time of purchase and are upset that you walked away with a negative variance between the car's value and the price you paid to purchase it. In managing projects it is important to understand the factors that influence and impact the execution of the project baseline so that thresholds for expected and acceptable variances can be established. It is much easier for project stakeholders to seek to understand a reported variance when variance thresholds have been communicated and planned for. So we now accept that the car depreciates, but what can we expect over time? On average cars tend to depreciate at about 15-20% of their value per year, with the first year being the steepest drop. With this knowledge, you can project the value of the car over time and expect the depreciation that coincides. The Wholesale Projection and Projected Depreciation columns in the table below provide the expected value of the vehicle over the next five years.  Now you are asking what is the Appraised Value and the Actual Depreciation columns and why do they vary from the Wholesale Projection and Projected Depreciation columns. The Wholesale Projection and Projected Depreciation set an expectation of what variance we should expect in the value of the car over time. The Appraised Value and the Actual Depreciation columns represent the actual value of the car at those points in time. WHAAAT?!? Yes, what I am saying is, you expect things to change, but they don't always change according to plan. The Wholesale Projection only accounted for a 20% linear depreciation over five years and took into account no other variables. In the Appraised Value column, Year 1 value was negatively impacted by an accident depreciating the car by $2,000.00 more than expected, setting a domino effect in play for the value over the next four years. This was further complicated in Year 3 by weather conditions that impacted the paint and exterior condition of the vehicle, reducing the condition of the car from good to fair. Had the accident and weather damage not occurred, it is likely the vehicles Appraised Value would have been relatively close to the Wholesale Projection. When Project Managers account for variance, it is common to see thresholds between

Now you are asking what is the Appraised Value and the Actual Depreciation columns and why do they vary from the Wholesale Projection and Projected Depreciation columns. The Wholesale Projection and Projected Depreciation set an expectation of what variance we should expect in the value of the car over time. The Appraised Value and the Actual Depreciation columns represent the actual value of the car at those points in time. WHAAAT?!? Yes, what I am saying is, you expect things to change, but they don't always change according to plan. The Wholesale Projection only accounted for a 20% linear depreciation over five years and took into account no other variables. In the Appraised Value column, Year 1 value was negatively impacted by an accident depreciating the car by $2,000.00 more than expected, setting a domino effect in play for the value over the next four years. This was further complicated in Year 3 by weather conditions that impacted the paint and exterior condition of the vehicle, reducing the condition of the car from good to fair. Had the accident and weather damage not occurred, it is likely the vehicles Appraised Value would have been relatively close to the Wholesale Projection. When Project Managers account for variance, it is common to see thresholds between